Finish in under 10 minutes

Prepare Your US Taxes With Confidence

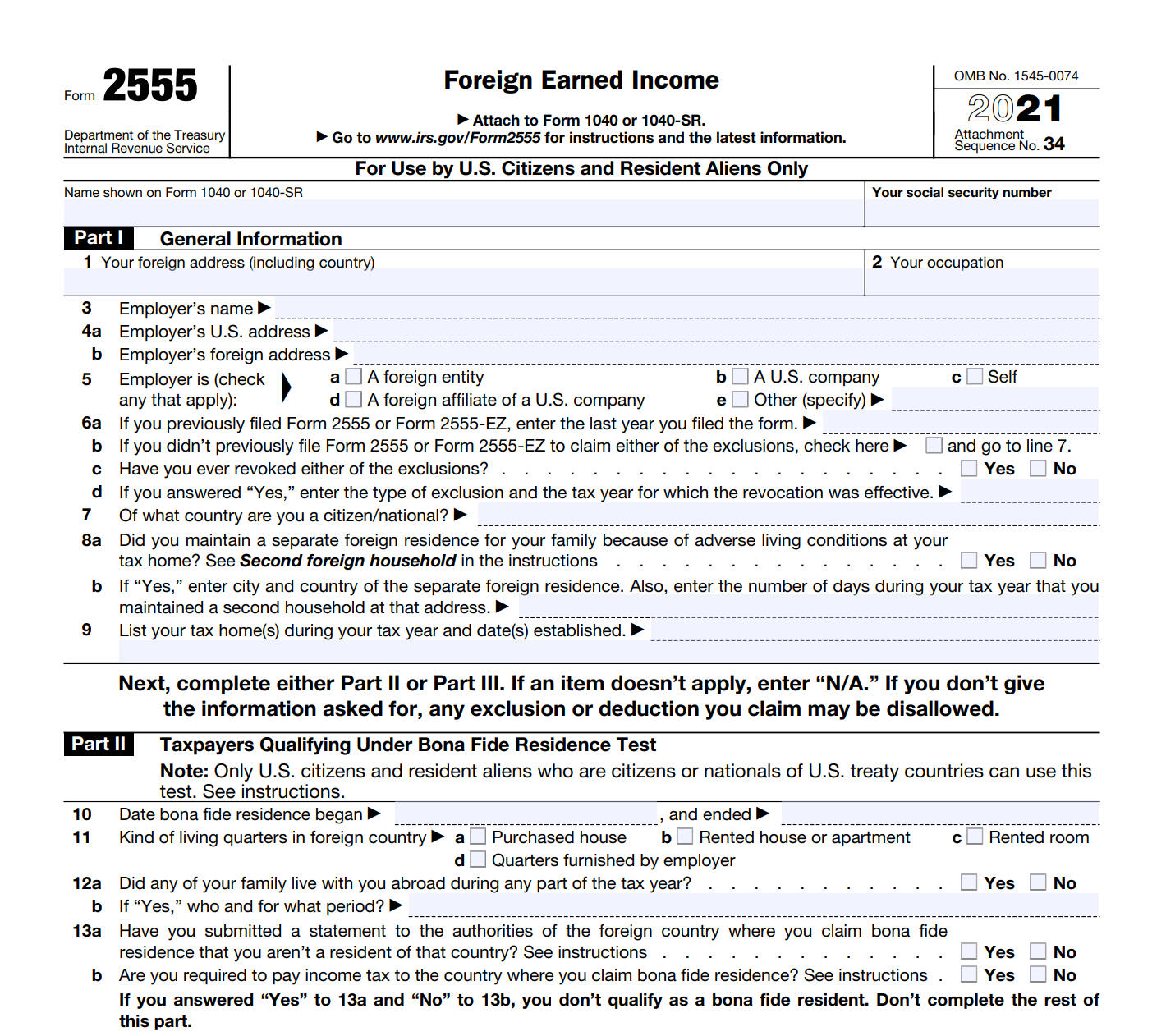

Avoid double taxation with the Foreign Earned Income Exclusion

The IRS makes it hard to be a US expat

Big penalties raise the stakes on confusing forms.

Hard to DIY, while tax pros break the budget.

Online services bait and switch with surprise upsells.

No more guesswork

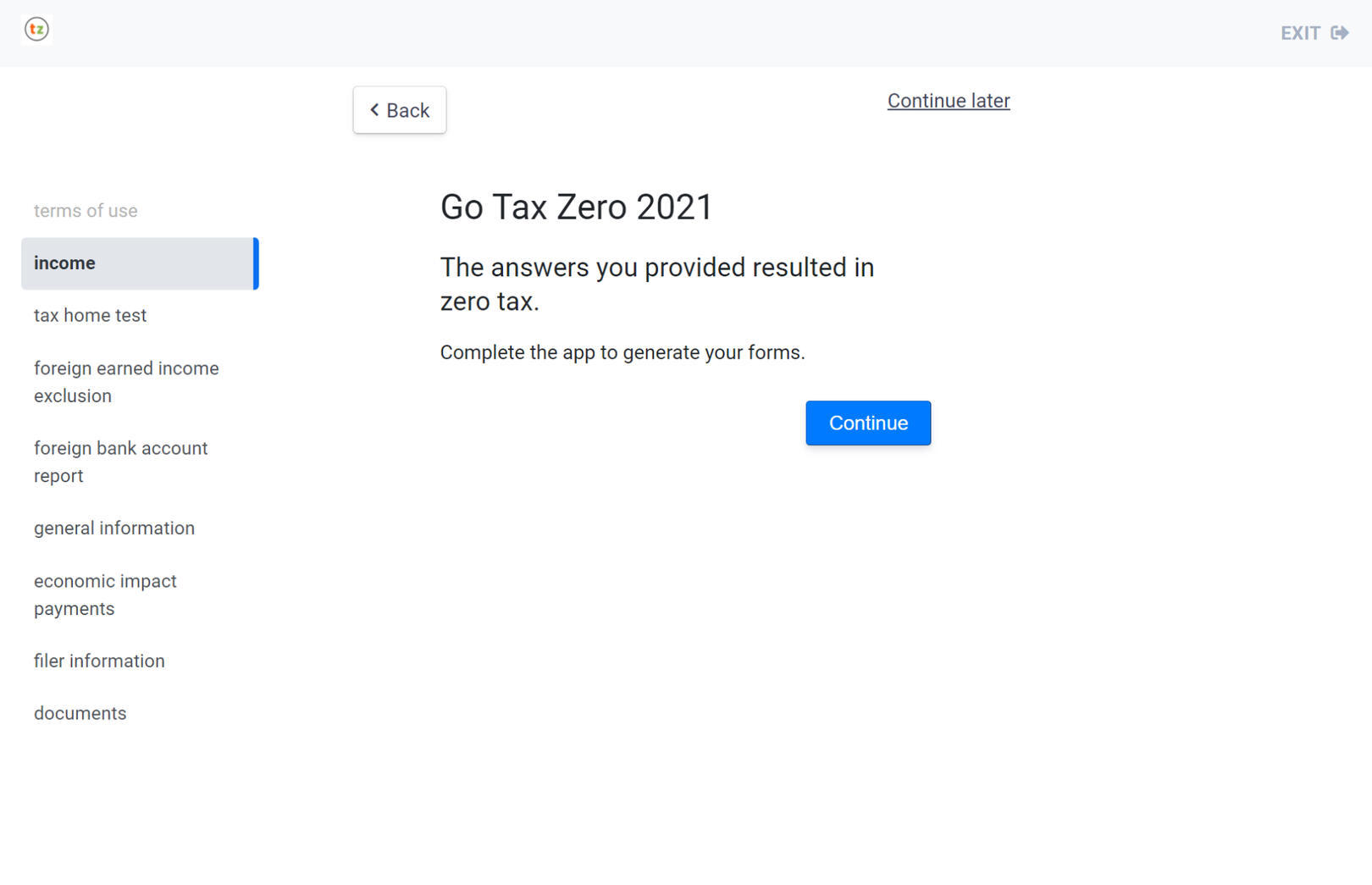

Answer the questions in the App

Print the official IRS forms created by the App

You're done in 10 minutes

The Tax Zero App is designed for Expats by Expats

Convert your local currency to USD

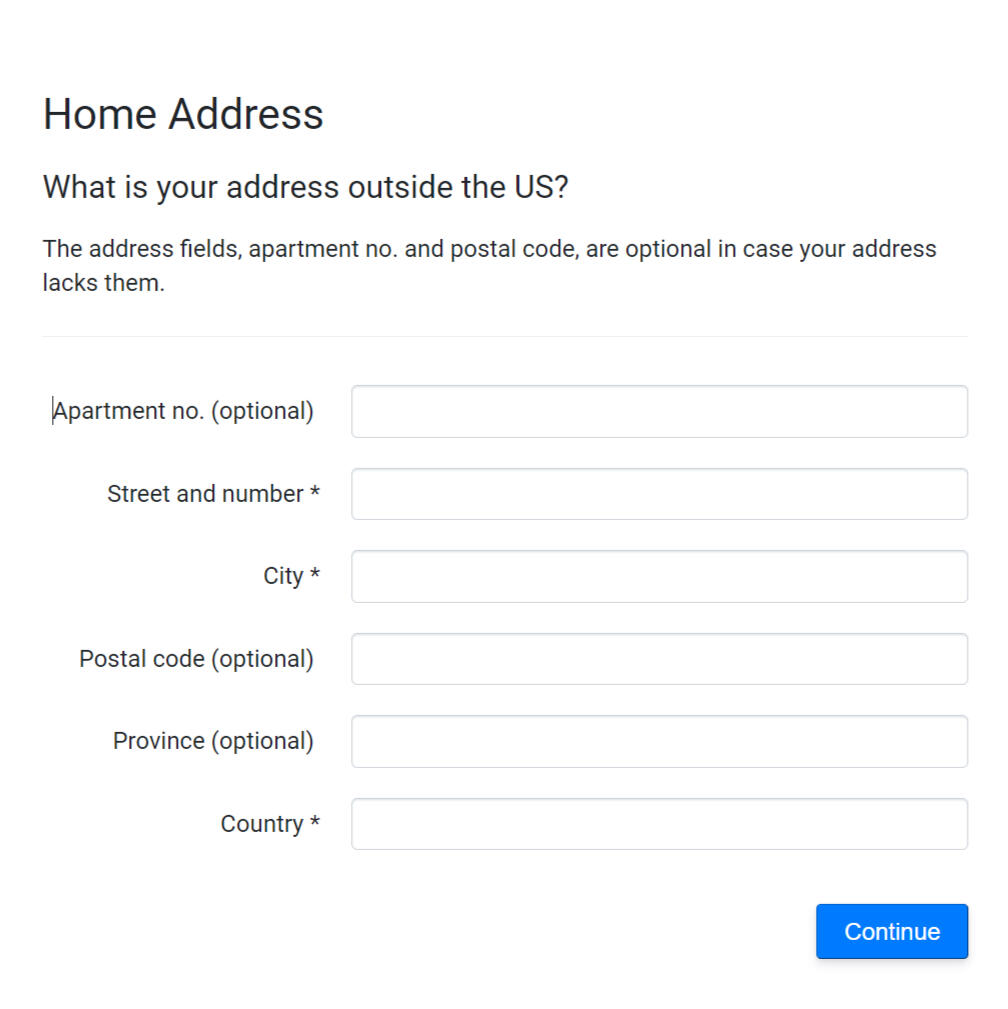

Use your non-US address

Spouse with no ITIN, no problem

Get Expert Guidance

We guarantee correct tax calculations

We help resolve any IRS letters

We answer your questions

How does the Tax Zero App work?

First the App confirms that your earned income is covered by the Foreign Earned Income Exclusion plus the standard deduction.Next the App confirms that you pass the tax home test to qualify for the Foreign Earned Income Exclusion.Then the App generates the official IRS tax forms for you to print and send to the IRS.The App will let you know if you need tax forms that are not supported or if you may be better off using Foreign Tax Credits to avoid double taxation.If the Tax Zero App doesn't fit your situation, we will refund your purchase or help you finish your tax return using our full tax software. It's your choice.

Who qualifies for the Foreign Earned Income Exclusion?

Qualify by Physical Presence or Bona Fide Residence.If you were located outside the US for at least 330 full days during the year, you pass the Physical Presence Test.If you were a tax resident of countries outside the US for the whole tax year, then you pass the Bona Fide Residence Test. Tax residents pay income tax to their local country.

What kinds of income are excluded?

The exclusion covers only income earned from work outside the US. "Earned" means wages, salary, commission, tips, and revenue from a self-employed business.Earned income is "foreign" when the work was performed outside US soil. Ask yourself where you were sitting when you did the work.The Foreign Earned Income Exclusion does not cover other types of income such as social security, pensions, capital gains, rents, royalties, and scholarships.

By Expats, For Expats

As expats, we understand how hard it is to finish our US taxes.

As professionals, we want to make it easy.Erik Dahl turns big ideas into practical next steps at Remote Works.Christine Dahl solves serious IRS problems at Dahl International Tax Law.